Unemployment rates, both locally and nationally, have increased significantly since mid-March due to the coronavirus pandemic and the forced closing of unessential businesses. South Carolina alone has surpassed 600,000 claims since the pandemic began.

Last week, the South Carolina Department of Employment and Workforce released this report that analyzes unemployment claims, rates + payments data across the state since the start of COVID-19 in the US. We’ve broken down some of the charts and numbers below.

SC COVID-19 unemployment by the numbers

Unemployment rates + claims

○ 12.1% – SC’s April 2020 unemployment rate

○ 2.5% – SC’s February 2020 unemployment rate

○ 582,265 – SC unemployment claims from mid-March to June 6

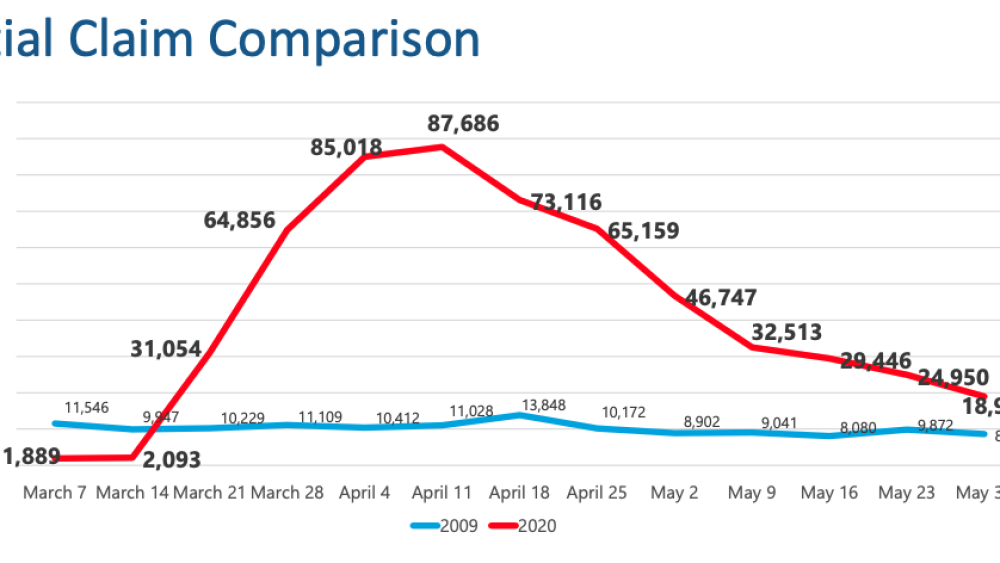

○ 76,658 – The difference in unemployment claims between the weeks of April 11, 2009 and April 11, 2020

○ $2.011 billion – Total amount of unemployment compensation paid in SC March 15-June 8

Industry impact

○ 23% – Claims from the accommodation + food service industry

○ 18.8% – Claims from the manufacturing industry

○ 11.9% – Claims from the health care and social assistance industry

○ 10.7% – Claims from the retail trade industry

○ 2.8% – Claims from the educational services industry

○ 4.2% – Claims from other industries (including barber shops, nail salons, etc.)

Unemployment Insurance Trust Fund

○ $807.5 million – Unemployment Insurance Trust Fund balance as of June 8, 2020

○ $1.05 billion – Unemployment Insurance Trust Fund balance as of June 30, 2019

Rebuilding the Unemployment Insurance Trust Fund

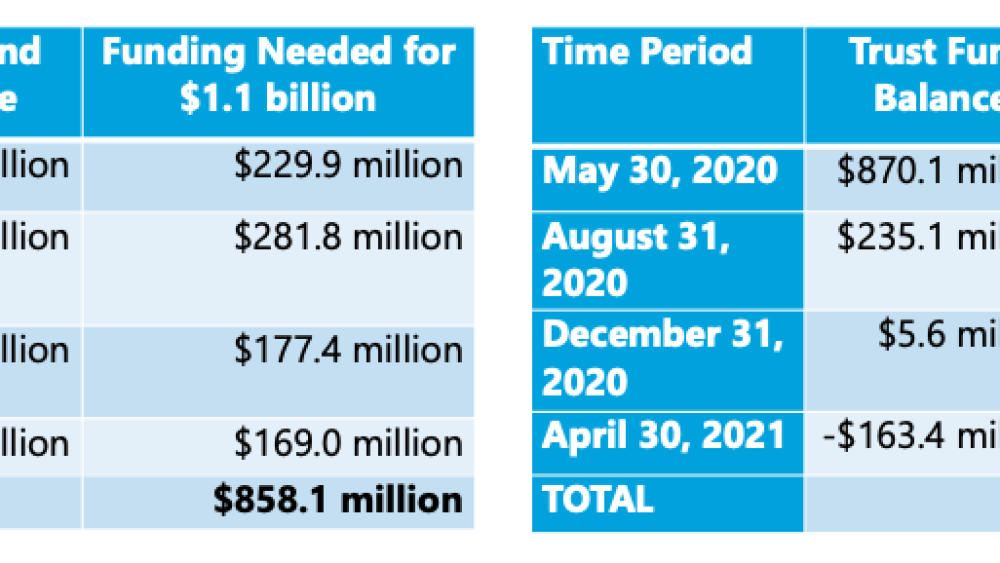

The SC Department of Employment and Workforce has developed two scenarios for rebuilding the Unemployment Insurance Trust Fund to $1.1 billion – one optimistic and one pessimistic. Both scenarios assume ~13,250 claims will be made each week for four weeks + then ~5,000 claims a week following the initial four weeks.

The optimistic scenario assumes that many who have filed unemployment claims will return to work in June or July. The pessimistic scenario assumes that most unemployment claimants will exhaust the 20 weeks of benefits they are eligible for. The graphs below show the predicted balances for each scenario over the next year.

The optimistic rebuilding scenario estimates that $858.1 million will be needed to replenish the fund by April 30, 2021. The pessimistic scenario estimates that $1.263 billion will be needed by the same date. The charts below show the projected balances + funds needed for each scenario.